Introduction

The outbreak of COVID-19 presents as a global health emergency, but also a significant social and economic downturn since the international financial crisis of 2008 and 2009. The economic crisis has become pronounced as countries apply strategic containment methods that require a near halt on economic activities in other to reduce the spread of the virus. This action is aimed at saving lives but not without a cost. The financial and human capital loss is likely to be higher in low- and middle-income countries (LMIC) like Nigeria. This situation is due to their significantly low Gross Domestic Product (GDP), shallow capital market, low potential for education, and wide informal segment (World Economic Forum, 2020).

The volatility of the Nigerian economy is evident in its dependence on the oil trade. The effect on this has resulted in a review of the National Budget oil benchmark from $50 to $30 per barrel. This fact reemphasizes the need for the government to diversify the economy as about 40 million Nigerians are living below the poverty line (NBS, 2020). This report seeks to explore the financing opportunities that are useful in not just mitigating the current and potential challenges of the COVID-19 pandemic, but also for the creation of a diverse economy that can withstand future socio-economic turmoil.

Financing policy suggestions

Moving towards a universal and inclusive social policy base requires time. Universalism is best achieved through a combination of policy instruments. To do so, Nigeria can start by implementing what Franzoni and Sánchez-Ancochea (2018) call policy architectures. The Federal Government of Nigeria has to think of the right structures to facilitate the creation of better conditions for universalism in the long run.

Policy architectures are “the combination of instruments that define who has access to what benefits and how” (Franzoni & Sánchez-Ancochea, 2018). These architectures can be thought of as a step-by-step process to achieving universalism involving five main components: eligibility, funding, benefits, provision, and outside option. The focus of this article is on funding options – who pays and how.

The suggested policy options focus on supporting Nigerian citizens out of poverty, lessening inequality, and providing financial stability, especially during these unprecedented times. One recommended action is to give everyone enough money to ensure basic sustenance and a minimum standard of living – universal basic income. The income is universal and unconditional, meaning you receive it regardless of who you are and what you do.

As simple as it sounds to transfer enough money into everyone’s account, every month to guarantee an essential livelihood, understanding how to finance such a programme or how much it would cost has proved to be a significant problem for both critics and even supporters. In light of this, we suggest tapping into repatriated funds, and potentially citizenship by investment programme for finance options.

Developing a robust and efficient taxation system

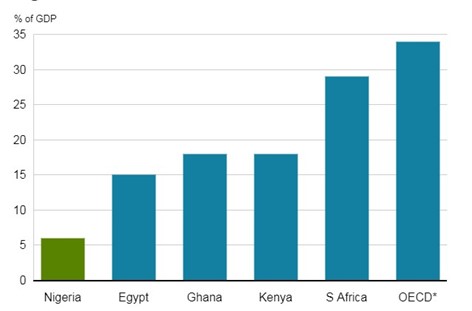

Taxation is one of the most significant and accessible income streams for both developing and industrialised nations. The tax structure in Nigeria remains weak, which can largely be attributed to the insufficient tax base data and strong dependence on income generated from crude oil sales. According to reports by BBC (2019), only 19 million taxpayers were accounted for by federal and state authorities. Conversely, reports by World Bank (2019) show that there are about 65 million taxable individuals. Examining the difference in both findings indicates that there are about 46 million (approx. 70 percent) individuals that are outside the tax system. The tax gap has been estimated at $46.9 billion. Figure 1 shows Nigeria’s tax gap compared with members of the

Organisation for Economic Co-operation and Development (OECD) and other African countries.

Figure 1. The relationship between Nigeria’s Tax Gap and GDP

Source: BBC (2019)

According to reports by OECD (2016), the ratio of tax to GDP in other developing economies like South Africa was 29 percent, Kenya 18 percent, and Ghana 18 percent. While that of Nigeria stood at 3.4 percent in 2016, and 4.8 percent in 2017 (BBC, 2019). An inclusive and equitable tax policy does not only serve as an active instrument for decreasing Nigeria's reliance on income from oil and gas export as well as dependence on development partners' assistance. A country of about 150 million individuals, the revenue capacity could guarantee a robust economy with financial strength useful in adapting to the global crisis such as disease outbreaks (Salami, 2011).

Nigerians in diaspora

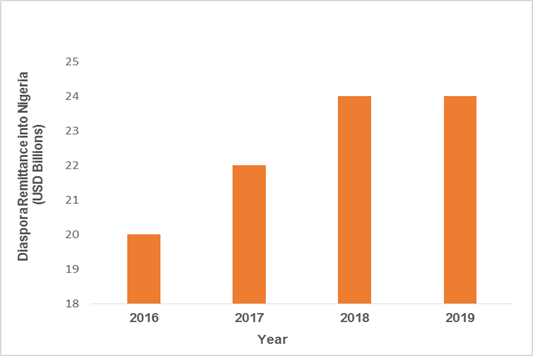

An analysis by the United Nations (2017) shows that there are approximately 1.24 million migrants from Nigeria in the diaspora. According to Punch (2017), Nigerians are about the most skilled immigrants, with a total annual income estimated at $65,000 per employee. These individuals are reported to be skilled and semi-skilled foreign human assets with $20 billion worth of inflows into Nigeria in 2016. The numbers have steadily grown from $22 billion in 2017 to $24 billion in 2019, as shown in Figure 2 (World Bank, 2020). Also, the Nigerian migrant remittance inflow stands at about 5.3 percent of her GDP. Concerning yearly emigration, the overall number of Nigerian emigrants rose from about 500, 000 individuals in 1990 to 1.3 million in 2017 (NIDCOM, 2019). The continuous growth necessitates the need for Nigeria to utilise this untapped resource through consistent and structured investment through the Nigerians in Diaspora Commission (NIDCOM).

Figure 2. The Annual Diaspora Remittance inflow

Source: Author’s analysis (Adapted from World Bank (2020)