Purpose

The purpose of this document is to achieve the following

- Use as a live document to guide the delivery of the project

- Document common understanding of financial inclusion, related gaps, barriers, and opportunities

FEMWA seeks to accomplish the following objectives

- To increase knowledge on management of personal income

- To increase hands-on-skill on the use of financial services such as Unstructured Service Data

- To increase awareness on how to assess financial products and services

Problem Context

Financial inclusion is described as enabling access to monetary resource and services for economic growth, particularly those on the lower end of the pyramid at a reasonable cost (Atkinson and Messy, 2013). Financial inclusion strategies are focused on increasing interaction of individuals without accounts in banks and other formal financial institutions. The interaction with the financial institutions is in inform of credit cards, debit cards, internet payment, mobile money services, among others. Nigeria’s financial inclusion strategy as documented by CBN (2013) states that financial inclusion is attained when adults Nigerians have easy access to a wide spectrum of formal financial services that meets their needs at affordable cost. Comparatively, Nigeria has made progress in the aspect of financial inclusion, but the country still lags when compared with other developing countries. An evaluation using formal indicators of inclusion show that Nigeria has declined from 53 percent to 46 percent in the period between 2008 and 2010 (Mbutor and Uba, 2013). More so, financial service providers that serve the informal sector decreased from 24 percent to 17 percent. Furthermore, Nigeria records 461 savings accounts per 1000 individuals. Relatively, this fell short when compared with that of Malaysia (2063 savings account per 1000 individuals). Similarly, Nigeria’s formal payments only serve about 22 percent of its population. This is lower than reports from South Africa or Kenya (46 per cent). Credit facilitation in Nigeria is unappealable. It is evident when assessing financial inclusion using credit penetration as the basis for evaluation. She posts 2 percent access to formal products, which significantly falls short of reports from African countries with comparable economic size such as South Africa (32 per cent). In view of the aforesaid, the government of Nigeria, using the Central Bank as an instrument to set certain objectives propelled by actionable steps.

The absence of financial inclusion is a dynamic socio-economic threshold that develops from several features such as geography, culture, history, religion, inequality, and economic infrastructure and policy (Hariharan and Marktanner, 2012). On the other hand, financial inclusion can serve as a foundation for economic growth and development. Above all, the is a strong and significant relationship between a country’s total factor productivity and financial inclusion. As a result, possess the capacity to generate wealth. According to khan (2011), financial inclusion possesses the probable capacity to grow the monetary savings threshold. This reveals emerging business opportunities as well as the propensity to enhance the standard of living of the low- income earners. He included that access fundamental financial services may purport to economic growth and employment opportunities particularly in rural communities. The multiplier effect would lead to availability of disposable income in vulnerable groups which will result development savings culture. Other desirable outcomes are an increased participation by various groups in the society and development of innovative solutions that’s aimed at improving the overall economy. Following this, financial inclusion will create an avenue for governments to carryout payment directly to the bank accounts of beneficiaries through electronic transfer channels. Thus, this will lessen transaction costs and improve accountability. Sarma and Pais (2010) reiterates that financial inclusion ascertains ease of access, availability and utilization of financial apparatus by a large segment of a society. Outside this, it greatly improves the daily management of monetary resources, reduce the frequency of informal financial interactions which maybe economically regressive.

Global context: Historical, Political, Cultural and Current

Over several decades, financial reforms have steadily evolved and extended from the confined area of microenterprise credit to the expansive concept of financial inclusion (FI) via microfinance. Others forms of FIs includes savings, money transfer services and insurance for the poor). In this regard, micro informal savings and credit institutions have been running for many years globally. As at the fifteen century, the Catholic Church established pawn shops as an option to informal money lenders. These pawn shops expanded as formal credit and savings organisations for the poor or persons in rural dwellings that were traditionally deselected by commercial financial institutions. A classic instance is the Ireland based loan Fund System had about 300 funds throughout Ireland. Another ancient example is the Indonesian People’s Credit Banks that was established in 1895 and grew to become the biggest microfinance institution in Indonesia (Helms, 2006). Around the 1800s, there was the advent of more established formal savings and credit organisations that prioritised operations on the rural and urban poor. Similarly, the German cooperative was opened to carter for the rural population, thus improving welfare and financial independence. In the same way, the early 1900s saw the emergence of savings and credit interventions in rural Latin America. The interventions were focused on mobilising savings and modernizing the agricultural sector on increased investment through credit. In the 1980s and 1990s, financial reforms evolved in most economies globally. As a result, these reforms were expected to enhance the financial background and the consistent utilization of services such as loans, savings, and payment services (Mbutor and Uba, 2013).

Several national governments and international organisations have financial inclusion as a developmental priority. This is in a bid to create a nexus between financial inclusion and the poor. In 2010, the Group of twenty (G20) countries presented a financial inclusion action strategy. This is in recognition of the vital role financial services play in enhancing the standard of living of vulnerable communities. More so, the group supported micro, small and medium scale enterprises (MSME), thus established the Global Partnership for financial inclusion to carry the agenda forward. Alongside the partnership, the Alliance for Financial inclusion (AFI) was established as a complementary exchange body for regulators in developing economies. The AFI is an avenue for national government to proclaim their financial inclusion strategies. Globally, financial inclusion is described as ensuring access to formal financial services at an affordable cost in a reasonable and crystal-clear manner (De koker and Jentzsch, 2013). This is often targeted at a large section of vulnerable communities and low- income societies (Mahendra, 2006). Described by Mahendra (2006), credit is vital to financial services. For this reason, financial inclusion eclipses several services such as savings, insurance, payments and remittance services delivered by formal financial organizations to those seem to be financially challenged. Financial inclusion can be a mechanism to alleviate poverty at the macroeconomic level by building resilience to economic shocks. A growing array of evidence indicates that economic development, in conjunction with appropriate regulation and supervision stimulates reduction in income inequality.

Currently, financial inclusion has progressively developed into priority objective in several developing countries. For this reason, the G20 supported the establishment of financial inclusion units in Central Bank and Ministries of Finance with the purpose of evaluating progress. In 2014, a global evaluation of assess financial inclusion strategies of 55 countries revealed that FI involves extending access to the previously excluded variety of financial services and products. Nevertheless, technology has played a vital role in enhancing financial inclusion especially in sub-Saharan Africa. Evidently, 12 per cent of adults have a mobile money account and 45 per cent of them depend singularly on mobile phones for formal banking (Mbutor and Uba, 2013).

Nigerian Context: Historical, Political, Cultural and Current

In the past, Nigeria has basically operated a cash in hand financial system. A significant amount of the money in the economy are convey outside the formal banking system. In the 1960s, about 61 per cent of cash flow were not recorded in the banking system. A decade after, the numbers fell to 44 percent and 40 percent in the 1980s. This decline has been attributed to the improved financial literacy programs, increased development in the financial sector, and the establishment of rural banking programmes and products (CBN, 2013). In the 1990s, the banking sector experienced political crisis. The struggles of the banking sector were exacerbated by excessive spending by the political class resulting to increased level of currency in the non-banking system. The per cent out plummeted to about 48 percent in this time. In 2004, the bank consolidated programme enabled financial services to deepen and decreased the percentage of unbanked cash flow to about 38 percent (CBN, 2012).

Many years ago, the government of Nigeria through its monetary authorities have developed several policies focused on percolating financial inclusion with the economy. The policies such as the initiation of community and microfinance banks, aimed at increasing financial participation and involving more people in the financial inclusion mechanism. Other institutional initiatives to promote financial inclusion is funding Small and Medium Scale Enterprises (SMEs) through the National Economic Reconstruction Fund (NERFUND) and Family Economic Advancement Programme (FEAP). FEAP was developed to focus on women who are significantly financially excluded compared to the male counterpart. Cultural norms excluded women from owning formal accounts due to a lack of identity as a result of “name changing” after marriage. It was difficult for women to meet with the perquisite for acquiring a bank account. Since 2005, financial services in Nigeria has experienced growth through deliberate attempt by government and regulatory authorities to expand financial inclusion frameworks.

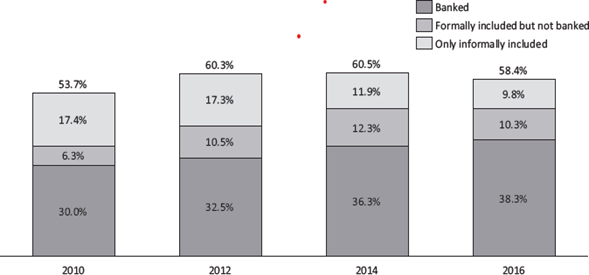

Between 2010 and 2014, the percentage of unbanked individuals have steadily decreased (Figure 1). One of several directives by the government of Nigeria to drive financial inclusion is the cardinal objectives of the Nigerian Financial System Strategy (Soludo, 2007). The aim is to provide easy access and process of engagement by the individuals that neither own a conventional account or a mobile money wallet.

Figure 1. Nigeria financial inclusion rates from 2010 to 2016

Source: EFInA Access to Financial Services in Nigeria 2018 survey

CONSTRAINTS TO WOMEN’S ACCESS TO FINANCIAL SERVICES

Although financial capacity and know-how challenges are distinct, given the technicality associated with electronic access (ability to use mobile Apps/phones to transact). Women are often not familiar with the use of digital technology outside the use of mobile phones to make calls. Moreover, there is presence of a learning trajectory on the part of women and financial service providers. In addition, women are unlikely to own a mobile phone compared to the men. This is as a result of the cost, cultural norms and social discrepancies that often inhabit ownership, registration guidelines for SIM cards and mobile money accounts. Majority of women reside in rural communities; these areas are often disfranchised by poor network coverage and streamline electronic channels. Another concern is the cultural differences which places women in a disadvantage position. Some ethnic groups consider male as the sole provider for the family, thus there are often more inclined to own bank account. Although Women carry out savings, but in informal way like keeping money in the house. The cost of financial services presents another barrier to women financial inclusion in Nigeria. Regardless of the woman income, the man operates the resources in the household. The tribe of Hausa culturally do not permit women to earn income. Thus, women are less inclined to afford the running cost of a formal account (Ananwude et al., 2018). A report by EFInA (2018) revealed that about 43 percent (21.4 million) of the women population have no access to financial services. Comparatively, about 36 percent (15.6 million) of the total male population are financially excluded.